Read along and learn more about Will Clemente Bitcoin.

Despite macroeconomic challenges, Bitcoin displays resilience, as highlighted by analyst Will Clemente.

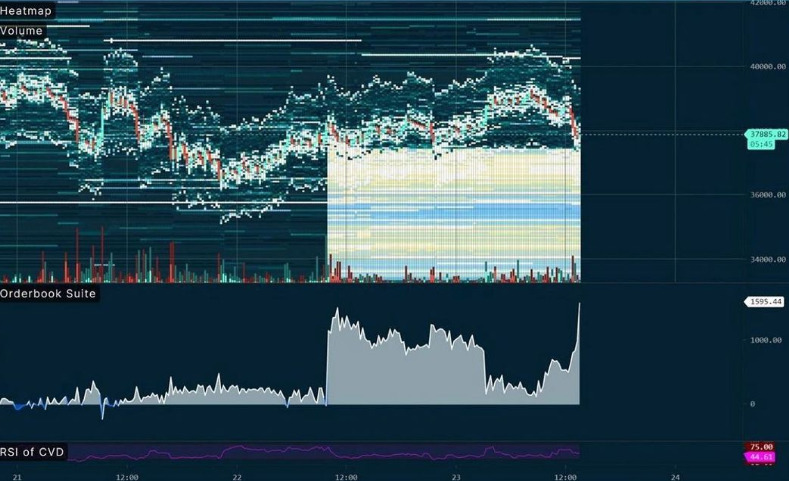

Renowned analyst Will Clemente recently examined Bitcoin’s present stance within the overarching macroeconomic context.

Thus drawing connections between extensive fiscal patterns and the future path of the digital currency

PHOTO Courtesy | Instagram

Who is William Clemente?

William Clemente, a 19-year-old sophomore studying finance at East Carolina University, is also a contributor to Bitcoin Magazine.

He specializes in simplifying topics related to finance and Bitcoin/on-chain analytics for easy understanding.

What impact will the expiration of $6 billion worth of Bitcoin options have on its price?

Will the price of Bitcoin drop below $30,000 per coin?

When Bitcoin’s price dipped below $30,000 per coin, many in the cryptocurrency community expressed concerns that it might signal the end of the bull market for this leading digital asset.

However, William Clemente III, a 19-year-old college sophomore from East Carolina University, remained more optimistic.

Are large holders of Bitcoin accumulating at the $30,000 level?

Earlier this week, Clemente noted that both Bitcoin whales and retail investors are accumulating significant amounts of the flagship cryptocurrency at the $30,000 price point.

He stated, ‘Retail investors have been making substantial purchases for weeks, and now we’re finally seeing an increase in whale activity, as we had been anticipating.

PHOTO Courtesy | Instagram

Will Clemente makes 6 key points about Bitcoin

- Top/Bottom Models: Realized Price and Delta Price show Bitcoin is near historical lows. $24,000 may be strong support.

- MVRV Z-Score: Bitcoin’s valuation suggests the potential for further decline. Historically, the green zone marks a bottom.

- Entity-Adjusted Dormancy Flow: Indicates generational lows, approaching levels seen in past bottoms.

- Reserve Risk: Holder confidence is relatively high but hasn’t reached the March 2020 level.

- Mayer Multiple: Currently in the buy zone, close to historical lows.

- 200-Week Moving Average: Traditionally serves as strong support, currently around $21,832.

In Summary about Will Clemente Bitcoin

The six points by Will Clemente suggest Bitcoin’s price might be close to a bottom.

However, none of these indicators have reached historical lows.

Some even hint at a drop to $20,000 or lower, which has never happened before in Bitcoin’s history.

Clemente’s conclusion:

“Most likely, the bottom will be in the low to mid $20,000 range, in line with the idea of anticipating the previous all-time high.

If you’re a long-term investor, ask yourself whether buying at $29,000 now or waiting for a possible lower price in two years matters.

Probably not, but it’s worth considering.”

ALSO READ : How to? verify Bitcoin on Cash App without ID